Soap & Candle Workshop Insurance

Professional Indemnity & Public/Products Liability Insurance for Soap & Candle Workshops

Annual Cover starting from

$64.53/Month

Instant Online purchases for

Workshops AND Retail

The soap, candle and body product industry is ever evolving. There are some incredibly talented makers out there who love to impart the skills within fun workshops alongside their business. So, with this demand, we’ve designed a workshop insurance policy that is a combined Professional Indemnity and General Liability policy.

This cover ensures you have the appropriate insurance to conduct the activities involved in teaching the general public how to make your products, as well as selling your own products online, or in person.

Why AUZi's Soap & Candle Workshop Insurance?

Included Activities

- Teach an unlimited amount of Workshops

- Market Stalls, Pop up Shops & Expos

- Retailing & Wholesaling

- E-Commerce (online)

Your Choices

- Multiple Policy Options

- $5mil, $10mil or $20mil Limit of Liability

- Include Retail sales

- Pay by Card, Bank Transfer or Monthly Instalments

Why do I need Insurance?

While Workshop Insurance is not a compulsory requirement – when it comes to Soaps and Candle Workshops, it’s an investment for the future of your business.

In the event of a claim, a consumer will want to take action against you for property damage or bodily injury caused by your products or your workshops. This is where the combined Professional Indemnity and General Liability Insurance will keep you covered under financial stress.

What Does AUZi's Soap & Candle Workshop Insurance Cover?

Professional Indemnity Insurance

Professional Indemnity Insurance is designed to protect you and your business based on any advice, services or coaching you have given.

Public Liability Insurance is designed to protect you and your business against Personal Injury or Property Damage arising from your Business activities.

Products Liability Insurance

Products Liability Insurance is designed to protect you against Personal injury & Property damage arising from the products you have sold.

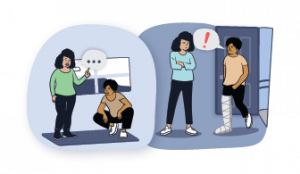

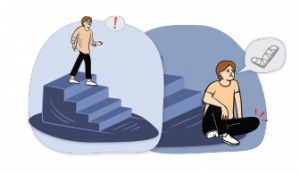

What could go wrong running a Workshop?

When manufacturing products, anything can go wrong. From the ingredients/recipe, to the design and the method. Once those products are no longer in your possession, anything can happen.

So, when it comes to teaching workshops, the same problems can and will occur. However, that risk increases. You’re now teaching someone all the ins and outs of the process. During, if you somehow misguide your student, or miss an important step, they could carry it on into their own small business.

Should a claim and/or incident occur with their products, they will be looking to you for compensation for their financial loss.

Supported Activities/Products

Newest Supported Product

Shaving Soap

- Antiperspirants

- Aroma Beads

- Bath Bombs/Fizzies

- Bath Brushes/Sponges

- Bath Oils

- Bath Salts

- Bath Sets & Kits

- Beard Oil

- Beard Balm

- Body Butter

- Body Cream

- Body Exfoliants

- Body Lotions

- Body Mists

- Body Moisturiers

- Body Paint

- Body Oil

- Body Polish

- Body Powders

- Body Scrubs

- Body Sprays

- Body Wash

- Bubble Bath

- Candle Accessories including wick trimmers, snuffers and dippers

- Candles - including Soy Wax, Palm Wax, Bees Wax, Coconut Wax & Paraffin Wax

- Candle Holders

- Car Diffusers

- Cold Processed Soaps

- Conditioner

- Deodorants

- Electric Burners 1

- Electric Diffusers 1

- Electric Melt Warmers 1

- Essential Oil Burner

- Essential Oil Roller 3

- Face Cream

- Face Masks 4

- Facial Cleanser 4

- Hair Balm

- Hair Conditioning Bars

- Hair Shampoo Bars

- Hair Treatment Bars

- Hand Washes

- Hot Processed Soaps

- Incense and Smudge Sticks

- Lipbalms 2

- Lip Scrubs 2

- Liquid Soap

- Massage Oil

- Melts

- Melt and Pour Soap

- Pillow mist

- Reed Diffusers

- Room Sprays

- Shampoo

- Shaving Soap

- Shower Gels

- Shower Steamers 4

- Simmering Granules

- Soaps for cleansing the hair

- Soaps for cleansing the skin

- Tealight Burners

- Washing Crystals 4

- Whipped Soap

- Dish & Laundry Soap (If Additional Cover Chosen)

1: As long as being sourced from local suppliers and are not being imported. Electrical Diffuser sales must be less than 10% of turnover. 2: Assuming Lip Balms sales do not count for more than 10% of turnover. 3: Subject to pure essential oils with carrier oil ingredients only 4: Subject to all ingredients being natural and non-hazardous.

We are revising Supported/Excluded Activities Constantly. If you cannot see your product on this list please contact us.

Important Info

All Products including manufactured and imported goods must meet and comply with Australian Standards and in particular ACCC, AICIS and TGA standards. Soap makers and/or importers must comply with AICIS requirements. It is also the customers duty to understand the requirements and whether they need to be registered with AICIS to be able to import, manufacture and sell their goods. Goods imported into Australia need to meet the applicable standards that are determined by the government.

Excluded Activities/Products

- Acne Preparation

- Any Baby related Products including Baby Soap Bars, Baby Wash, Baby Lotion, Nappy Cream

- Any Product made for use on animals

- Any skin or hair product with medicinal, antiseptic or therapeutic intention claims. Refer to TGA cosmetic advertising guidelines

- Barrier Balms, Creams, Lotions, Ointments

- Certain Skin Lightening Preparations

- Cleaning Products of any kinds

- Cuticle Oils

- Disinfectant

- Essential Oil blending for any items that are not on the supported list

- Essential Oils used in any way other than within products listed in the supported products list above

- Exfoliators

- Furniture Polish

- Hand Sanitiser

- Head lice prevention activities

- Insect repellent, creams or sprays

- Lipstick / Lip Gloss

- Nail Polish

- Oral Hygiene including Tooth Soap

- Perfumes / Solid Perfumes / Perfume Balms

- Perfumes (eau de toilette, eau de colognes, eau de parfum)

- Shaving/ Aftershave Balms, Shaving/Aftershave Lotions, Shaving Creams

- Skin Salves

- Stain Remover

- Sunscreen / Sun Balm / Sun Butter / Sun Paste

- Surfboard Wax

- Toners

- Washing Powder/Detergent

- Zinc

- Dish & Laundry Soap (If Additional Cover NOT Chosen)

Your Dedicated Contacts

Chat live with our Specialist Brokers, Nicole & Tracy by hitting the live chat bar below. Only available during Office hours.

Alternatively, give us a call on 1300 939 698, or email us at mail@auzi.com

Not quite what you're looking for?

Enter your craft below and search from our database of 300+ Occupations.

On the Blog

Implications of Cancelling your Product Liability OR Professional Indemnity Cover.

Products Liability is an occurrence-based wording. This means, the insurance needs to be in place at the time the incident/injury/damage occurred for there to be a valid claim.

Professional Indemnity Insurance is a Claims Made wording. This means an insurance policy needs to be in place at the time you provide the service and at the time of the claim and/or incident in order for your interest to be protected.

If you cancel your insurance today and an incident is notified and/or occurs tomorrow for a product or service you provided last week, you will not be covered. Read more on this here.