Mobile Caterer's Insurance

Public & Products Liability Insurance for Mobile Caterers

Annual cover starting from

$40.74/Month

Instantly generated Quotes, Purchase online in minutes.

As a Caterer, your career will have you pulled into many areas. From weddings to children’s parties, at times it can be a wild ride. Nevertheless, your clients always expect the best from you in contributing to their big day.

From quality produce and a knockout menu to the element of layout and design, a lot goes into keeping your client happy. Taking out Caterer Insurance for your business with a Public and Products Liability policy is a way to protect yourself if something unforeseen was to happen. That could result in your client or another third party bringing a claim against you. Being mobile, there are many risks that could occur in any element of your small business.

Why AUZi's Mobile Catering Insurance?

The Benefits

- Instant Quotes & Certificate of Currency

- Purchase Online, 24/7

- Specialised policy, tailored to your industry

Your Choices

- Multiple Policy Options

- $5mil, $10mil or $20mil Limit of Liability

- Pay by Card or Bank Transfer, or Monthly Instalments

Why do I need Caterer's Insurance?

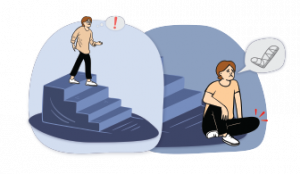

Legal costs can add up very quickly. When a customer engages you to provide a service, they expect nothing but the best. Human error does happen. The last thing you need is to worry about losing your livelihood in the event a customer brings a claim against you for loss or damages. Without Insurance, you’re at risk of losing everything from just one claim.

Our cover includes Public and Products Liability so you can rest assured knowing you have the right cover in place for your business.

What Does our Mobile Catering Insurance Cover?

Public Liability Insurance

Products Liability Insurance

Products Liability Insurance is designed to protect you against Personal injury & Property damage arising from the products you have sold.

What could go wrong as a Mobile Caterer?

The risk that a client or any member of the public can suffer food poisoning from either food you have prepared yourself or arranged to have is very real. No matter how careful you are, this can still happen. So, it is important you protect yourself. Moreover, you could potentially cause property damage and injury in the course of delivering the food, or picking up supplies. Being mobile, there are endless situations that this could occur.

Mobile Catering Insurance Options

Three Months

from $157.52

at $5,000,000 Liability

Your Choice:

- $5mil, $10mil or $20mil Limit of Liability

Six Months

from $252.12

at $5,000,000 Liability

Your Choice:

- $5mil, $10mil or $20mil Limit of Liability

Annual Cover

Lowest Daily Rate

from $444.40

at $5,000,000 Liability

Your Choice:

- $5mil, $10mil or $20mil Limit of Liability

This Policy cannot cover Restaurant Owners and Operators

Not quite what you're looking for?

Enter your craft below and search from our database of 300+ Occupations.

Your Dedicated Contacts

Chat live with our Specialist Brokers, Nicole & Tracy by hitting the live chat bar below. Only available during Office hours.

Alternatively, give us a call on 1300 939 698, or email us at mail@auzi.com

On the Blog

Implications of Cancelling your Product Liability.

Products Liability is an occurrence-based wording. This means, the insurance needs to be in place at the time the incident occurred for there to be a valid claim.

If you cancel your insurance today and an incident is notified and/or occurs tomorrow for a product or service you provided last week, you will not be covered. Read more on this here.